What type of phone insurance do you need?

Choosing the right type of mobile phone insurance is straightforward. You'll usually have a choice of plans with different cover levels.

Policies with the highest levels of cover will cost the most, but it's important that you choose a level of protection that suits you.

You can compare our phone insurance plans in the table below:

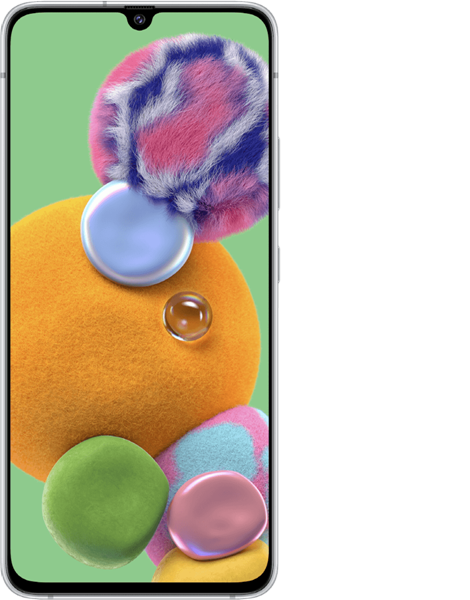

About the Samsung Galaxy A range

Series highlights

With the A90 5G you’ll get ultra-fast downloads and streaming thanks to next-generation 5G connectivity. This model also features Samsung's 6.7inch Infinity Display.

The A9 (2018) was the first phone to feature a quad camera, including a 24MP primary camera and a 2x optical zoom second telephoto lens.

The A8 and A8+ have a dual-lens front cameras. Samsung’s Live Focus feature uses these to blur the background in your selfies.

The A7 (2017) has up to 22 hours of battery life and fast charging.

The A & J range

The Samsung Galaxy A and J series smartphones offer mid-range alternatives to the premium Galaxy S line models.

The A-series has solid features and a great value spec without the premium price you pay for the S models.

The J series was discontinued in April 2019, however, at Insurance2Go, we’ll still insure your Galaxy J-series handset if you bought it new within the last 36 months.

Why insure your mobile phone with insurance2go?

-

Instant cover

Whether you buy a monthly or annual policy you’re covered from the moment you buy.

-

Any make, any model

We insure any phone – bought new or refurbished – from a UK-registered company if it was supplied with a warranty (even if you've owned it up to 3 years already).

-

Unlimited claims

Accidents happen, so that's why there's no limit to how many claims you can make.

-

94% of claims accepted

You won't have to bend over backwards to prove your claim. In 2024, we approved 94% of mobile phone insurance claims*.

-

Here since 2007

We were one of the first businesses to provide specialist insurance for mobiles and gadgets. And, as part of the SPB Group, we have even more experience dating back to 1965.

-

Flexible insurance plans

Choose to pay for a year upfront, or pay on a rolling monthly basis.

Get covered in three easy steps

-

Get a great quote

All we need is your device make and model to show you your options

-

Choose your policy

Select your cover, enter your details and pay – it takes just a few minutes

-

You're covered

Once you've bought the cover, your policy documents will be on their way to you

Your cover in detail

Accidental damage

Whether it's a cracked screen or button fault, if your Samsung phone gets damaged by accident we’ll repair it. If it’s not repairable, we’ll replace it.

Malicious damage

We'll cover you for any damage caused to your phone intentionally by anyone outside your immediate family.

Liquid damage

If any fluid gets into your phone and causes damage or makes it stop working as it should, we'll repair it - if it’s not repairable, we’ll replace it.

Mechanical breakdown

Repair or replacement if your phone develops mechanical problems, for example, fails to charge, becomes unresponsive, develops camera faults.

Worldwide cover

With Insurance2go, your phone has unlimited worldwide cover. So you're insured wherever in the world you are if anything happens to it

Instant cover

You're covered from the moment you complete the sign-up process - and that takes just minutes.

Loss

Losing a phone can be stressful and worrying. We'll get a replacement to you if you accidentally lose yours.

Theft

Get a speedy replacement if your phone – or any part of it - is stolen.

eWallet Payments

You're covered for up to £100 if your phone is used to make unauthorised contactless payments.

Unauthorised usage

We cover you for up to £1,000 for unauthorised calls, texts and downloads made within 24 hours of your Galaxy phone being lost or stolen.

With any Insurance2go policy your phone is covered for…

Not just a bad look, a cracked screen can make your phone unusable. Worse, a cracked screen may also mean internal damage, too. We'll repair your phone if the screen gets cracked, or replace it if we can't.

Liquids can be hazardous to the inner workings of mobile phones. If any type of fluid gets inside and damages your phone, you’re covered for repair, if it's not fixable, we'll replace it.

The randomness of life means your phone could get damaged at any time. If it does, we'll fix it or replace it. It'll need to be more than just cosmetic damage which won't be covered by your insurance.

Sometimes a phone develops a fault that stops it responding, no matter what you do. When you can’t make anything happen, it’s good to know you’re covered by people who can.