What is gadget insurance?

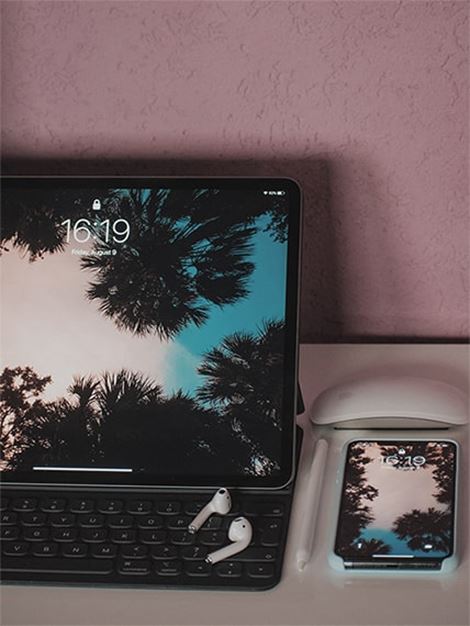

Gadget insurance is all about giving you peace of mind by protecting your favourite devices – whether it's your smartphone, laptop or tablet. This way, you can enjoy them without stressing over any unexpected mishaps. You might also hear gadget insurance referred to as 'tech insurance', 'electrics insurance' or 'device insurance'.

Gadgets can be expensive to fix and replace. If you have one that you use all the time and can’t live without, you may want to consider gadget insurance that covers you for various risks.

What does gadget insurance cover?

In this video, we break down exactly what's covered when you insure a gadget with us. Depending on your policy, you can get cover for accidental damage, mechanical damage, loss, theft and more.

Do I need gadget insurance?

Gadget cover is an easy way of protecting you from the costs of repairing or replacing a lost, stolen or damaged device.

We can't all afford to replace a lost, broken or stolen item as quickly as we would like, so gadget insurance is an ideal backup if anything goes wrong. It gives you financial protection and saves you from costs towards repairs or replacements. Our range of different cover plans means you won't have to settle for a one-size-fits-all option.

"Gadgets are no longer just accessories – they’re essential tools in our daily lives. Whether it’s a smartphone for work or a laptop for personal use, the cost of replacing a damaged lost or stolen device can be eye-watering. Gadget insurance isn’t just a safety net – you may decide to protect against unexpected disruptions so you can relax knowing that even the most unpredictable moments are covered." James, Customer Service Agent

What does our insurance for gadgets cover?

-

Cracked Screen

A cracked screen can make your gadget unusable, and it could also lead to internal damage.

-

Liquid Damage

Liquids can be harmful to the inside of your gadgets. If water or orange juice gets inside and damages your gadget, insurance could cover repairs or replace the item.

-

Physical Damage

The randomness of life means your gadget could get damaged at any time. If it does, a gadget insurance policy may fix or replace it.

-

Theft & Loss

While we can’t recover a lost or stolen gadget, if you have Theft & Loss coverage, we may be able to replace it.

-

Unresponsive or Blank Screen

Sometimes a gadget develops a fault that stops it from working, no matter what you do. When you can’t make anything happen, it’s good to know we can provide you with cover.

-

Worldwide Cover

Many of us take a least one gadget with us when travelling. See if your insurance provides travel cover, and if there are any limitations while you're away.

Can I insure a refurbished gadget?

A refurbished gadget is a previously owned device that has been inspected and tested to ensure it’s functional and in condition for resale. We can offer insurance for refurbished gadgets. However, if your gadget is second-hand because it's been passed down, or you bought an iPhone from a seller site, such as eBay, you must check to make sure you can insure it.

We cover second-hand or refurbished devices as long as they are from a UK-registered supplier and come with a 12-month warranty, even if they are purchased from an online auction site. We also cover a handed-down device as long as proof of gifting and purchase is available.

Laptop insurance

We can help protect your laptop against key risks with our gadget insurance. Laptops can be pricey, and damage, loss or theft can cost you more than expected. Being covered for these risks can keep down costs and offer reassurance – especially if you travel frequently with yours.

Which laptops do we insure?

We cover most laptops, including MacBooks and Chromebooks, as well as Dell and Microsoft devices – as long as your laptop was bought in the UK and is no more than 3 years old since purchasing it. Once insured, your coverage can continue even after the device is more than 3 years old.

Tablet Insurance

Modern tablets can be expensive and gadget insurance helps cover the cost if yours is damaged, lost or stolen. With instant cover, you get protection wherever you travel*, plus unlimited claims and high-quality repairs and replacements.

What tablets do we insure?

We insure most tablets, including iPads by Apple, plus Samsung, Huawei, Lenovo tablets and more. Just double-check that you bought yours here in the UK within the last 36 months.

Mobile Phone Insurance

We can help protect your phone against key risks with our gadget insurance.

Mobile phones go everywhere with us, so if you're tech-y or simply love your phone, then insurance should be on your to-do list. And it's not just for when you're clumsy, it can provide peace of mind if your phone gets lost, stolen or damaged. It can also protect you from expensive replacements or repairs.

What phones do we insure?

We cover phones by Apple, OnePlus, Huawei, Samsung, Oppo, Google and more. In short, we cover most makes and models – as long as your phone was bought new or refurbished in the UK within the last 3 years at the time of purchasing the policy. Note that when you're insured, your coverage can continue even after the device is more than 3 years old.

We cover second-hand or refurbished devices from a UK-registered supplier that come with a 12-month warranty. We also cover devices that have been handed down if proof of gifting and purchase is available.

Why choose gadget insurance with insurance2go?

-

Coverage straight away

You get instant cover whether you buy a monthly or annual policy with us.

-

Unlimited claims

There isn't a limit to the amount of claims you can make, because we understand that gadgets can be prone to accidents and other mishaps.

-

Most makes and models

If your new or refurbished gadget was bought in the last 36 months and from a UK-registered company, we could give you the cover you need.

-

Flexible plans

You can pay for a year upfront or pay monthly on a rolling basis – you decide.

-

15+ years' experience

We were one of the first UK companies to offer specialist insurance for gadgets and mobiles, which is why we provide great perks designed to work for you.

-

24/7 claims portal

If you need to make a claim, you can do so at any time of day using our claims portal, making the process less of a hassle.

Insurance2go is a great gadget Insurance company easy to join and very helpful recommend to all.

Want to get insurance for your technology? Get a gadget insurance quote with us online today. It's super quick and easy and you'll be in capable hands. We were one of the first to offer this type of protection for your devices and we're rated 'Excellent' on Trustpilot.

As soon as your policy is set up, you can find out how to manage your insurance by heading to the 'Your Policy' tab. Otherwise, you can visit our Help & support, contact us online or call our customer support team on 0333 999 7905 during our opening hours.