What does phone insurance cover?

Choosing the right type of mobile phone insurance is straightforward. You will usually have a choice of plans with different cover levels which provide varying degrees of protection for your phone.

Mobile insurance policies which provide the highest levels of cover will cost the most, but it’s important that you choose a level of protection that suits you.

You can compare our phone insurance plans in the table below:

Why insure your mobile phone with insurance2go?

-

Instant cover

Whether you buy a monthly or annual policy you’re covered from the moment you buy.

-

Any make, any model

We insure any phone – bought new or refurbished – from a UK-registered company if it was supplied with a warranty (even if you've owned it up to 3 years already).

-

Unlimited claims

Accidents happen, so that's why there's no limit to how many claims you can make.

-

94% of claims accepted

You won't have to bend over backwards to prove your claim. In 2024, we approved 94% of mobile phone insurance claims*.

-

Here since 2007

We were one of the first businesses to provide specialist insurance for mobiles and gadgets. And, as part of the SPB Group, we have even more experience dating back to 1965.

-

Flexible insurance plans

Choose to pay for a year upfront, or pay on a rolling monthly basis.

Get covered in three easy steps

-

Get a great quote

All we need is your device make and model to show you your options

-

Choose your policy

Select your cover, enter your details and pay – it takes just a few minutes

-

You're covered

Once you've bought the cover, your policy documents will be on their way to you

Would highly recommend insurance2go... Very easy to follow, very nice people to speak to. Have no complaints 👌

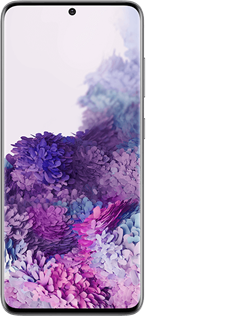

Popular handsets

Here are some of the most popular phones that our customers buy polices for - if you see yours take a look at what we could offer you.

Why buy phone insurance?

There are plenty of good reasons for and against phone insurance, but the choice is up to you. We've narrowed down just some of the reasons below why we think our phone insurance is worth it.

We know that accidents happen, and while we can't cover you against absolutely everything, we've come pretty close. We are also always improving and refining our products to meet our customers' needs, but if you have any changes you would like to see let us know.

We constantly review the market to make sure that we are giving our customers the best possible value. Take a look at the comparison table above to compare our prices, or get a more precise quote for your model.

Like all insurers we have to keep an eye out for potential fraud, but there's no need to worry when it comes to making a claim. Our process is simple and quick while we also have one of the best claims acceptance rates in the market.

We don't outsource our repairs, instead our in-house fulfilment team conducts all repairs on devices with manufacturer grade level parts. If we can't repair your device, we'll replace it wherever possible with a like for like replacement.

Brands we cover

We insure most makes and models of mobile phones. Find yours and discover what great cover we can provide for you.

What affects the cost?

-

Policy excess

Our policies have a set policy excess amount payable in relation to any claim made. This allows us to ensure that your premiums for cover remain as competitive as possible.

-

The model of phone

It wouldn't make sense to charge the same premium for a top of the range iPhone and a 3 year old Nokia - so we don't! The storage size could also have an impact.

-

Policy term

Usually, it is cheaper to pay 12 months upfront than one month at a time. This is true with our policies too, so make sure to take a look at both when you get a quote.

-

Insurance tax

No matter who you buy your mobile insurance from, all premiums will have 12% added for tax purposes.

-

Cost of repairs and replacements

The cost of repairing or replacing a newer model of handset is higher due to parts and replacement costs. The premium amount you pay will always take into consideration your specific device.

-

What you are covered for

Your premium amount will vary dependant on the level of cover you chose. Optional cover such as theft and loss cover will increase the amount that you pay for your premium.