Our new business cover protects phones, tablets, laptops and desktops, all through a dedicated online journey that our team has been working on tirelessly for the last few months.

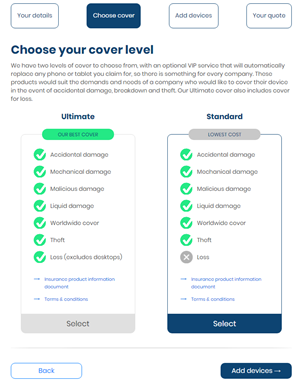

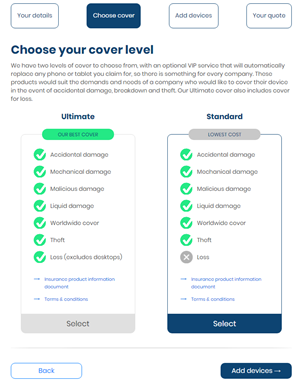

What’s covered?

Choose between our two new levels of cover, that now include theft, accidental damage, mechanical breakdown and worldwide cover as standard, with the option to add loss cover.

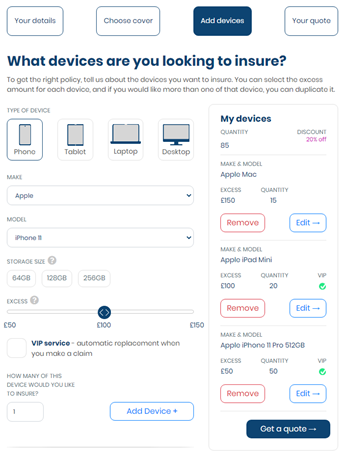

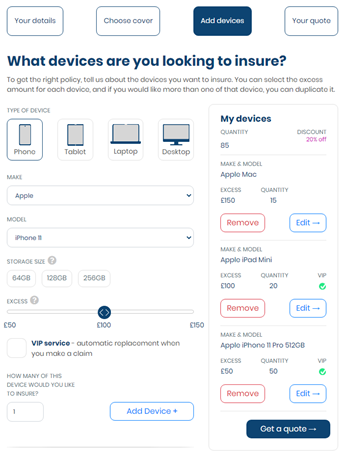

But that’s not all, you can now add multiple gadgets onto one policy – a first for Insurance2go Business – so you can cover the phones, tablets, laptops and desktops that keep your company going. We are also offering up to 20% multi-gadget discount depending on the number of devices you choose to insure.

You can now select the excess you pay for each device from £50, £100 or £150, giving choice to your new policy.

On top of that, we’re offering a new 24-hour VIP service, for phones and tablets, that ensures you receive a replacement device immediately when you make a successful claim, so your business can get back to normal, quick.

Getting a quote

Once you’ve added multiple devices, your discount will automatically be added to your quote.

When you’re happy, a quote will be instantly generated, and you’ll receive an email confirming all the details of the devices you wish to insure, and the cost of the policy for both a monthly and annual premium. Your quote is valid for up to 30 days.

Retrieving an existing quote

*This quote was made for illustrative purposes, no customer data was used*

If you’re waiting on approval, or just get side-tracked on another task, it’s easy enough to pick up where you left off.

Simply click ‘Retrieve Quote’ on the email you receive to jump right back into the journey and continue buying your policy.

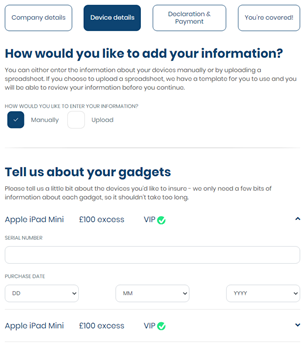

Finishing the purchase

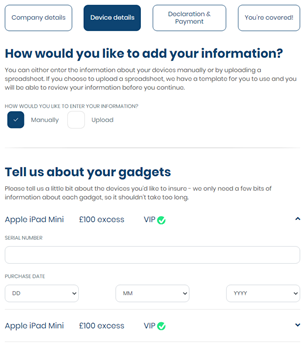

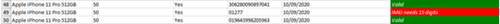

Once you’ve entered all your business’ details, you will then be asked to enter the IMEI or serial number and purchase date of the devices you’ve registered. You can either enter those details manually on the website, or if there’s a lot of devices on your quote, by entering the information on our handy spreadsheet.

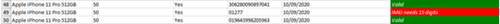

If you choose to add your device details through the spreadsheet provided, simply click to download the template, and complete the document in your downloads. You will not be able to edit the devices registered, only input the IMEI/serial number and purchase date of each device. There is an automatic authentication function inside the spreadsheet that will be able to tell you immediately if your details are valid.

Once you’re done, upload your file back onto the buying journey, where the devices will populate with the information provided.

We recommend that when you’re adding 20 devices or more, adding the device details via the spreadsheet is the easiest way to do so.

You have various ways to pay for your policy which will be led by whether you choose to pay monthly or annually. When you’ve entered your payment details, all of your devices are instantly protected and you will receive two emails to confirm your purchase, one of which include your policy documents.

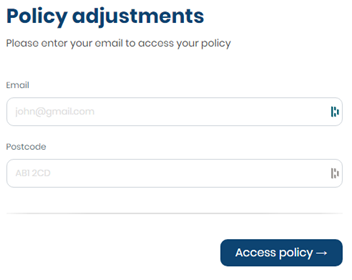

Making changes to your policy

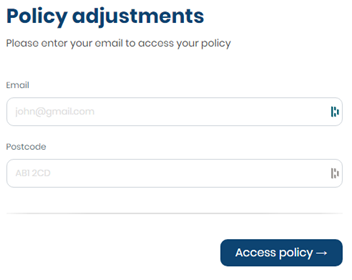

You can make a change to your policy by contacting us anytime, and after 20 days, you will be able to make changes to your policy through our new portal.

Simply request a link here and if the details you entered match a policy on record, you will then receive an email with a link to the portal.

When you enter the portal, you will be met with a summary of your policy, and the option to edit any information, including the excess levels for each device, cover level and policy term. You will also be able to remove and add any devices to your policy.

Depending on the changes you make, your premium may change, resulting in you making an upfront payment, or receiving a refund.

Once you have updated your policy, you will receive an email from us outlining the details of your updates.

Renewing your business policy

If you have purchased an annual policy from us before 08/09/2020, after 11 months you will receive an email from us letting you know that your policy is about to expire. If you wish to continue your cover, you will need to follow the instructions outlined on the email, which you can do completely online.

Once you click through, you will access your portal, where you will be given a summary of your policy. From here you can edit any information like the policy adjustment journey above, or if you’re happy with your current cover, just confirm and renew.

Please note that for our business customers, your policy will not auto renew. So if you do not click through and agree to the renewal, your policy will expire, leaving your gadgets unprotected.

If you do not wish to renew your policy you don’t need to do anything, simply wait for it to expire. It will not continue without your agreement.

If you have purchased any business policy from us after 08/09/2020, your policy will renew automatically.

Making things easier for customers

All of these changes were made with the aim to digitise the end-to-end experience for our customers, putting you in complete control of your policy. From an instant multi-item quote to mid-term policy adjustments and annual renewals, everything is now available online.

Lorraine Higham, our Managing Director had this to say: